The Cloud Storage Bubble

A decade ago, when DriveHQ was founded, most people did not understand Online Storage. VC's would turn away because they didn’t feel it was an attractive investment. The DriveHQ team had a vision and belief that Online Storage would eventually not only be useful, but necessary for all businesses and even the average consumer. DriveHQ has quietly worked hard to develop a broad range of technologies and products.

In 2007, the term "Cloud Storage" became popular. Suddenly, with a simple folder sync service and referral system, Dropbox was able to attract a large number of users. Almost overnight, the Cloud Storage industry suddenly became extremely attractive. By this point, VCs in Silicon Valley have created a massive Cloud Storage bubble.

Unfortunately, those VCs are in a risky situation now, and many have been disappointed by the fact that their investment has not emerged as the single leading Cloud Storage provider.

Many VCs and tech editors assumed that in the online service business, a single winner will take all. That seems to be the case for other online industries, e.g.: Amazon is the largest online retailer, eBay is the largest auction site, Google is the dominant search engine, and Facebook is the largest social networking site. However, the online storage industry is quite different from other online services, as there be no single winner in the Cloud Storage industry.

On the surface, it seems that Cloud Storage is not all that different from other services. It is based on the cloud and there is no country or location barrier, just like Facebook. The reality is, the Online Storage business is heavily divided.

- • There are free services, consumer services, and business services. A single provider can hardly dominate all three areas, especially if they dedicate their resources to providing the best in one of those fields (Dropbox, for example, invested heavily in developing their consumer services, while their business services are severely lacking).

- • Apple, Google, Microsoft, and others all offer Cloud storage services. Any startup company, regardless of its size and the amount of funding it receives, cannot possibly dethrone these giants, especially on their own platforms.

- • Cloud storage may not even be an independent service. It is best used as part of an integrated suite of services, such as DriveHQ's cloud IT service.

- • The current leading startup cloud storage service providers, such as Dropbox and Box are not able to drive out competitors because they lack business technologies and operational efficiency. On the consumer side, they are being pressured by the giants such as Apple, Google, and Microsoft; on the business side, they don’t have any advantage on price or features when compared with DriveHQ.

VCs hope their investments will eventually win out. An analysis will help determine whether it is even possible for Dropbox to win the market, as well as the likelihood of a main competitor like Box to win the market.

The problem seems to lie in its business model; of which Dropbox's does not appear to be effective. Most of its 200 million users are free users; they don't bring revenue to Dropbox, but rather add to the cost. Doubling the user base may not even help, given that they are unlikely to begin charging free users–as this is the major attraction of Dropbox. Considering competitors like SkyDrive and Google Drive already offer more storage space for free than Dropbox, it cannot realistically monetize its free user base. So it will have to redesign its business model entirely to become a serious player in the business market. Ironically, Dropbox is refocusing its business model towards enterprise customers; as opposed to the current consumer-focused model that has been its claim to fame.

Dropbox claims 4 million business customers. Judging by its revenue, Dropbox seems to be referring to its paid users as its business users, because the average user is only paying about $62/year, despite starting at $795/year for 5 users–the startup cost for Dropbox for Business. Unfortunately, Dropbox is in too deep a hole, and Dropbox for Business will not be successful for two reasons:

- • Dropbox service was originally designed for business, and it lacks the many features enterprise users will need to effectively and efficiently operate.

- • To support its valuation, Dropbox has to charge a high price for its business service. At $795/year for just 5 users, Dropbox for Business is not competitive. DriveHQ offers significantly more enterprise features–we offer Cloud IT service for only $6/user/year. Dropbox has such a great brand name and marketing power, so it is able to convince many more companies to look into its cloud service. However, when presented with a choice of Dropbox and DriveHQ, businesses will have no reason not to choose DriveHQ. Every day, we are seeing users switch from Dropbox to DriveHQ because we simply offer more features, such as online backup, FTP, WebDAV, email backup, file hosting, and enterprise folder sync. As previously mentioned, the service price is so much lower that companies have not found a reason not to try DriveHQ's cloud IT service.

In terms of brand name and marketability, Box is quite a bit smaller than Dropbox. For Box to emerge as the market winner, it has an even greater barrier to overcome. While Box refocused its model to better serve businesses well before Dropbox, it is still made the switch much later than DriveHQ. In terms of products and technologies, Box is lagging; it does not offer online backup, it does not have enterprise folder synch, it does not offer reliable WebDAV and FTP service, and it does not offer web hosting and file hosting services. Even if Box can develop its technologies to match DriveHQ, the main problem that Dropbox faces is even more daunting.

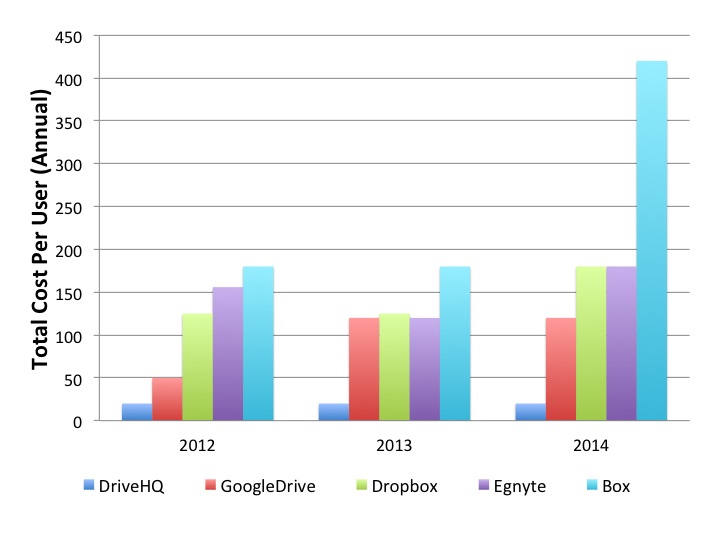

Dropbox and Box could dramatically lower its business service prices. However, if they dropped from $125/user/year and $180/user/year respectively to match DriveHQ's service price of $6/user/year, their revenue could drop by over 80%. Their market value would crash, and the VCs investment will crumble.

Dropbox's valuation of $8 billion and Box's valuation of $2 billion are clearly based on market speculation that they will become the winners. But the reality is, this is not a feasible task for either company. To keep their bubbles from bursting, they will have to continue to raise VC funds in order to stay afloat, and their consumer price ill have to be lowered, causing business prices to remain incredibly overpriced. If no winner emerges, eventually consumers will funnel out to more cost efficient and business efficient companies. Their business model is a ticking time bomb, and it’s only a matter of time before their bubble bursts.

Leave a Comment